Note that in your first year of freelance work in Germany, you may be required to make more frequent monthly VAT returns.Īdditionally, everyone who charges VAT is required to submit an annual VAT return at the end of each financial year. For this reason, it’s a good idea to make the return as soon as you can, to avoid late payment. Most freelancers make a VAT return at the end of each quarter, with any payment you owe due on the 10th of April, July, October and January. Please note that from 1 July to 31 December 2020 these VAT rates have been reduced to 5% and 16%, in response to the Corona crisis.

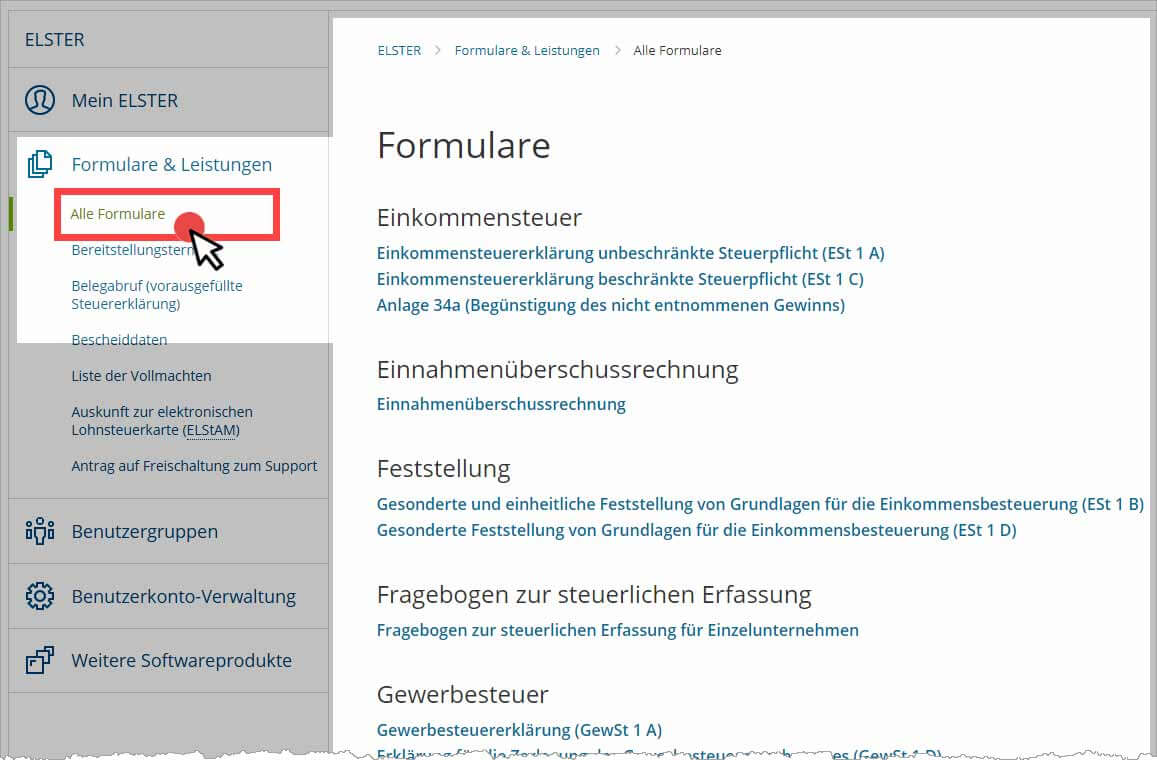

Which rate you need to charge your clients will depend on what kind of work you are undertaking. In Germany, VAT is charged on most goods and services, at one of two rates: 7% and 19%. This is a tax on goods and services which also applies to the services you offer as a freelancer. If you are a freelancer working in Germany and earning more than 22,000 EUR per year, you will most likely have registered to pay value-added tax (VAT), or Umsatzsteuer in German. Here we walk you through how to file your VAT (or Umsatzsteuer) return and submit it to ElsterOnline, the German tax office’s online service. Because of this announcement about the end of life of ElsterFormular this is only for reference installations and for test purposes.Submitting your VAT return to the Finanzamt doesn’t need to be a headache. Please check the ElsterFormular web site here: Please hold in mind: for all tax declarations since 2020 the tax office only accepts online declarations. If you are searching for a solution about an actual tax declaration: There is no way to download old versions and also this isn't supported or desired by any German tax office.ĮlsterFormular is written in Qt, but it is a Windows-only application. This is the reason why you will find here in AppDB only reports about the latest version. So this software is outdated and only for test purposes.

It is for paperless tax declarations according to the tax system in Germany and is only available in the German language.Īs a German taxpayer, you will have to use exclusively an online version on the web. ĮlsterFormular is the official tax software for German taxpayers with an online module that did the data exchange with a tax office. NOTE: Accourding to the German tax authorities this software is deprecated.

0 kommentar(er)

0 kommentar(er)